Perry Stokes Airport (KTAD)

📑 Reports

Development Timeline 2025–2029

Click any project bar to view details

Airport Vision

Purpose

Further development of the historic Perry Stokes Airport will require a coordinated effort between business stakeholders and public entities. This proposal provides a 10 year development roadmap with key milestones that are needed to create new economic opportunities at and near the airport. The milestones in this report are a mix of private and public development efforts.

Vision

Our vision for Perry Stokes airport is to create opportunity. By reducing the infrastructure, business incentive, and aviation service barriers to growth, we believe development will occur. The milestones established in this report are intended to encourage general, commercial, and military aviation utilization that will benefit our community and fund continued airport growth.

- A full service FBO capable of meeting all aircraft support demands, including overnight hangaring capability

- Runway access and safety improvements

- Dedicated helipads and hot refuel points to deconflict rotary and fixed wing traffic

- Up to 12 privately owned 60x60' (or similar sized) hangars

- Support to an industrial park focused on advanced manufacturing businesses

By 2035, conditions are set to pursue more advanced aviation opportunities, such as a flight for life base, boutique passenger air service, or vocational flight and maintenance training.

Current Limitations to Growth

The last two years have shown significant growth across General, Business, and Military Aviation segments. However, further growth is limited by a number of infrastructure and service factors:

- Apron and Traffic Pattern Capacity: Due to a high volume of helicopters using the airport, parking is limited and the traffic pattern is often busy.

- Overnight Hangar Capacity: No overnight hangar capacity results in reduced overall utilization of the airport by business aviation customers. Aircraft that do visit the airport are less likely to stay overnight due to severe weather risks.

- Runway Access: No parallel taxiway and no provision for aircraft to turn around on Runway 03 makes access to the runway challenging and potentially hazardous when the airport is busy.

Immediate Airport Infrastructure Needs:

Immediate Airport Facility Needs:

Immediate FBO Service Expansion Needs:

Is Commercial Passenger Service Possible at KTAD?

Commercial Air Service at Perry Stokes Airport is a long term vision requiring 10-15 years of sustained investment and demonstrated growth. This section establishes the realistic framework for achieving scheduled passenger service while setting appropriate expectations.

Similar Communities Have Achieved This

- San Luis Valley Regional Airport (Alamosa): With a service area population only modestly larger than Las Animas County, Alamosa enplanes over 12,000 passengers annually through Essential Air Service Subsidy.

- Taos Regional Airport: Perhaps the most relevant model, Taos enplanes over 6,800 passengers per year through scheduled public charter routes to Austin and Denver—achieved without EAS designation or the federally rigorous Part 139 Airport certification.

Two Paths to Commercial Service

| Essential Air Service | Scheduled Public Charter | |

|---|---|---|

| Federal Subsidy | Yes - DOT subsidizes operations | No - market-driven |

| Airport Certification | FAA Part 139 required | Part 139 not required |

| Federal Oversight | Extensive - inspections, ARFF, staffing | Standard GA requirements |

| Passenger Cost | Lower (subsidized fares) | Higher (unsubsidized) |

| Trinidad Viability | Possible but highly unlikely | Primary pathway |

Infrastructure Prerequisites

Commercial service cannot be solicited until critical CIP projects are complete:

- 2028-2033: Runway 03 Turn Around ("teacup"): Runway 03 cannot support larger passenger aircraft without a spot to turn around and back taxi.

- 2035: Runway Extension to at least 7,500': This project is an extremely large project but is a pre-requisite to allow takeoff and landing for larger aircraft carrying many passengers.

- 2035: Appropriate Passenger Facilities: When passenger service is scheduled, Pinnacle Jet Centers will vacate the historical airport terminal which will require further modifications to render it effective for passenger operations. The airport will require parking facilities to meet the increased parking demand.

- 2035-2037: Partial Parallel Taxiway: Larger charter carriers may be willing to use a teacup as an interim solution, but a full length parallel taxiway will be a necessary long term runway access solution.

Community Conditions Necessary for Commercial Air Service

Infrastructure alone does not justify commercial air service. Scheduled public charter flights operate without federal subsidy, meaning fares will be higher than subsidized routes. Service viability depends on local area travel demand.

Pinnacle Jet Centers' role: Our mission is to promote development of Perry Stokes Airport for the benefit of aviators and the local community. We will continue laying the groundwork for commercial air service from the facility and operations side—pursuing passenger terminal upgrades, generating increased business aviation activity, pursuing hangars, and expanding services. This work proceeds regardless of whether commercial service is ultimately pursued, as it supports the airport's broader growth.

The community's role: Only community stakeholders and elected officials can determine whether funding costly infrastructure upgrades in pursuit of commercial passenger service is in the community's best interest. This decision requires a deliberate assessment of whether Trinidad and Las Animas County have reached the economic conditions necessary to sustain air service. We recommend that Las Animas County, the City of Trinidad, Trinidad State College, and the Emergent Campus collectively develop a set of community readiness conditions that indicate that the local area is ready to support commercial air service.

Potential readiness indicators might include:

- Advanced manufacturing presence: An operational industrial park with one or more advanced manufacturing employers generating regular business travel demand.

- Technical industry growth: Establishment of homegrown or relocated technical companies providing higher-wage employment and attracting out-of-region visitors.

- Piñon Canyon workforce expansion: Increased civilian and contractor employment at the Piñon Canyon Maneuver Site, generating consistent government-related travel.

- Population growth: Population growth in Trinidad and Las Animas County may point to growing economic vitality.

- Tourism infrastructure expansion: Development of major attractions such as expanded ski operations at Cuchara, destination lodging such as Cougar Canyon, or outdoor recreation facilities drawing visitors from beyond driving distance.

- Healthcare or educational anchors: Expansion of Trinidad State College programs or Mt. San Rafael Hospital services that draw students, patients, or professionals from a wider region.

- Corporate or institutional investment: Relocation or expansion of businesses with headquarters or operations elsewhere, creating regular executive and employee travel needs.

Airport Operations Data

Perry Stokes Airport has seen significant growth in high-value civilian jet and helicopter operations, while overall traffic patterns reflect military deployment cycles and flight school adjustments.

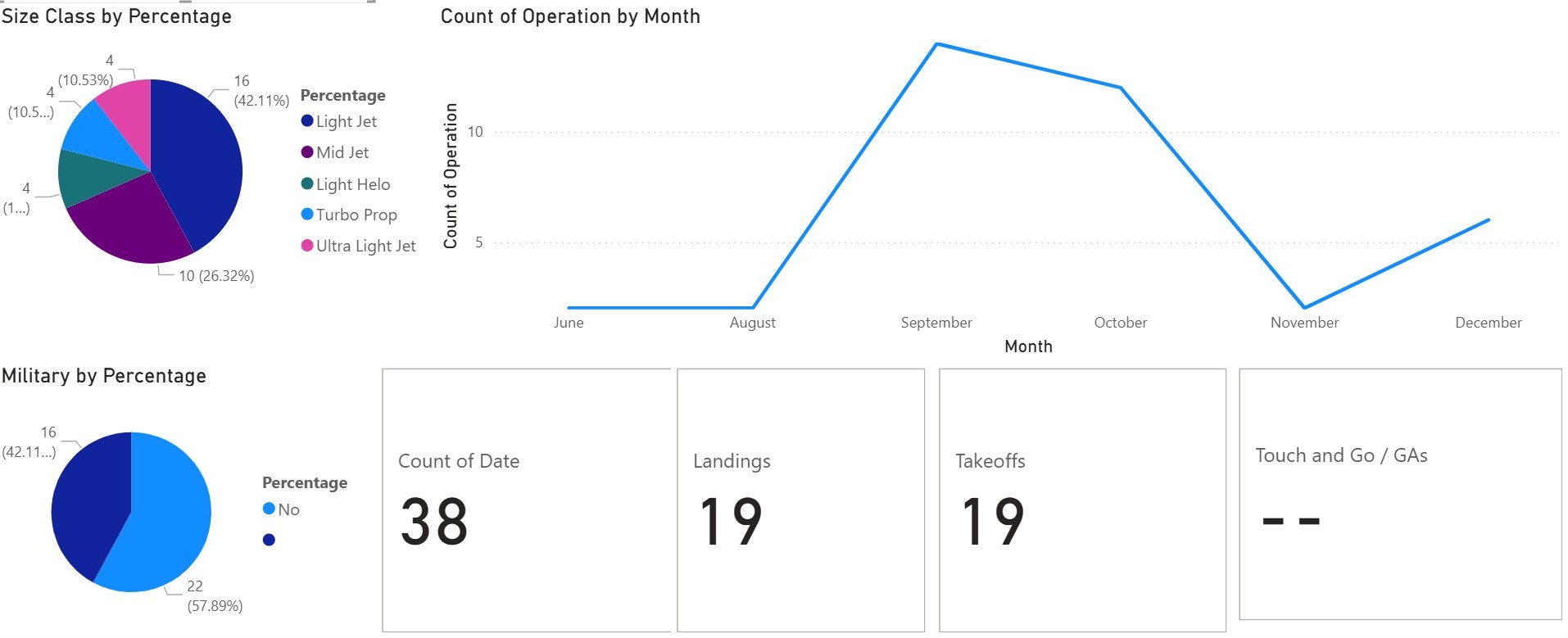

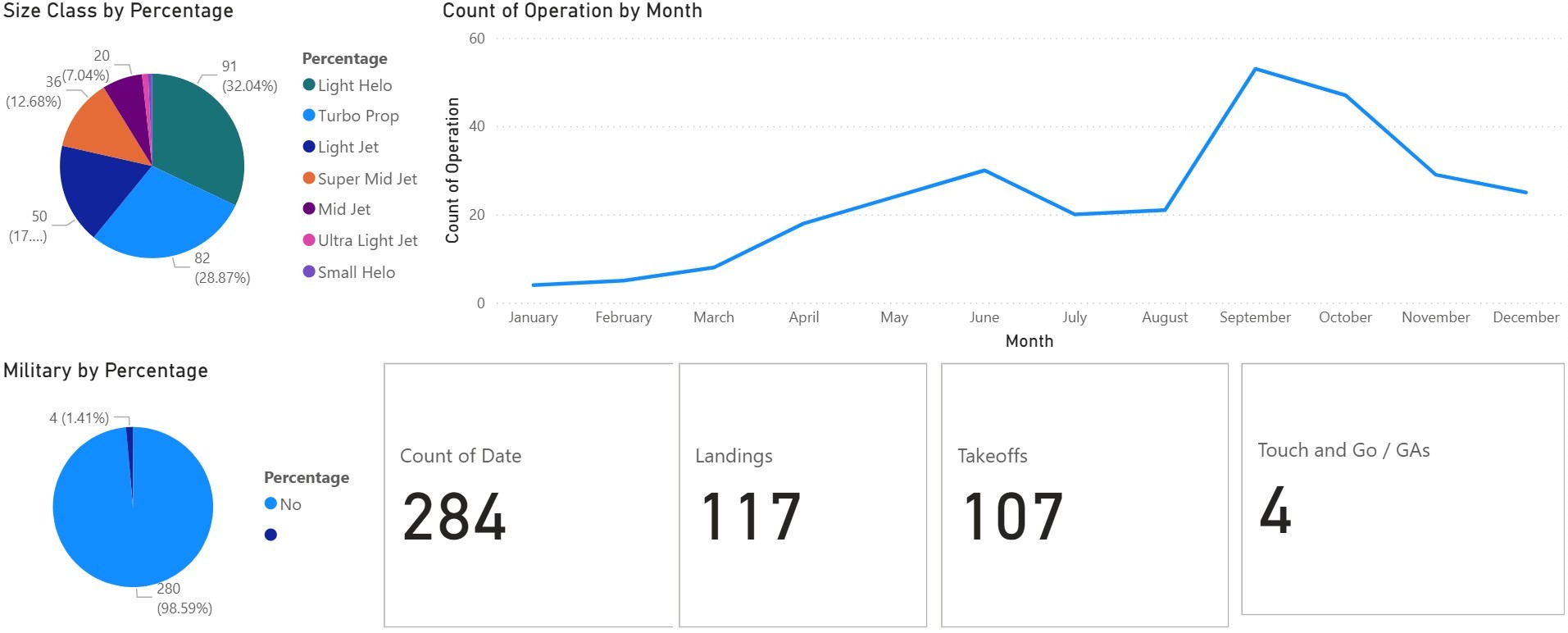

Civilian Jet & Helicopter Operations: A Growth Story

Civilian jet and helicopter operations have grown dramatically—from just 38 operations in all of 2024 to 284 in 2025, a 647% increase. With rental car partnerships now in place and a hangar share program operational, we expect this trajectory to continue through 2026 and beyond.

2024 Civilian Jets & Helos

38 total operations (19 landings, 19 takeoffs)

Click to enlarge

2025 Civilian Jets & Helos

284 total operations (117 landings, 107 takeoffs, 4 touch-and-go)

Click to enlarge

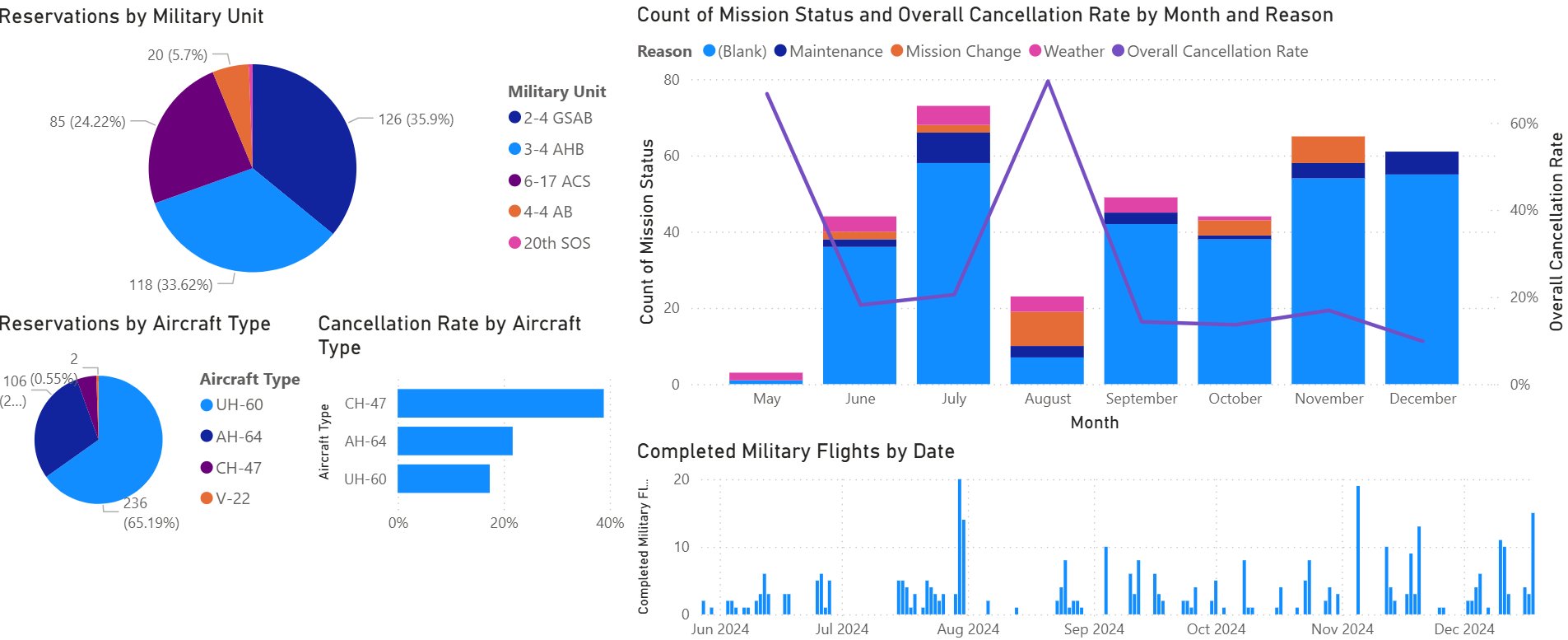

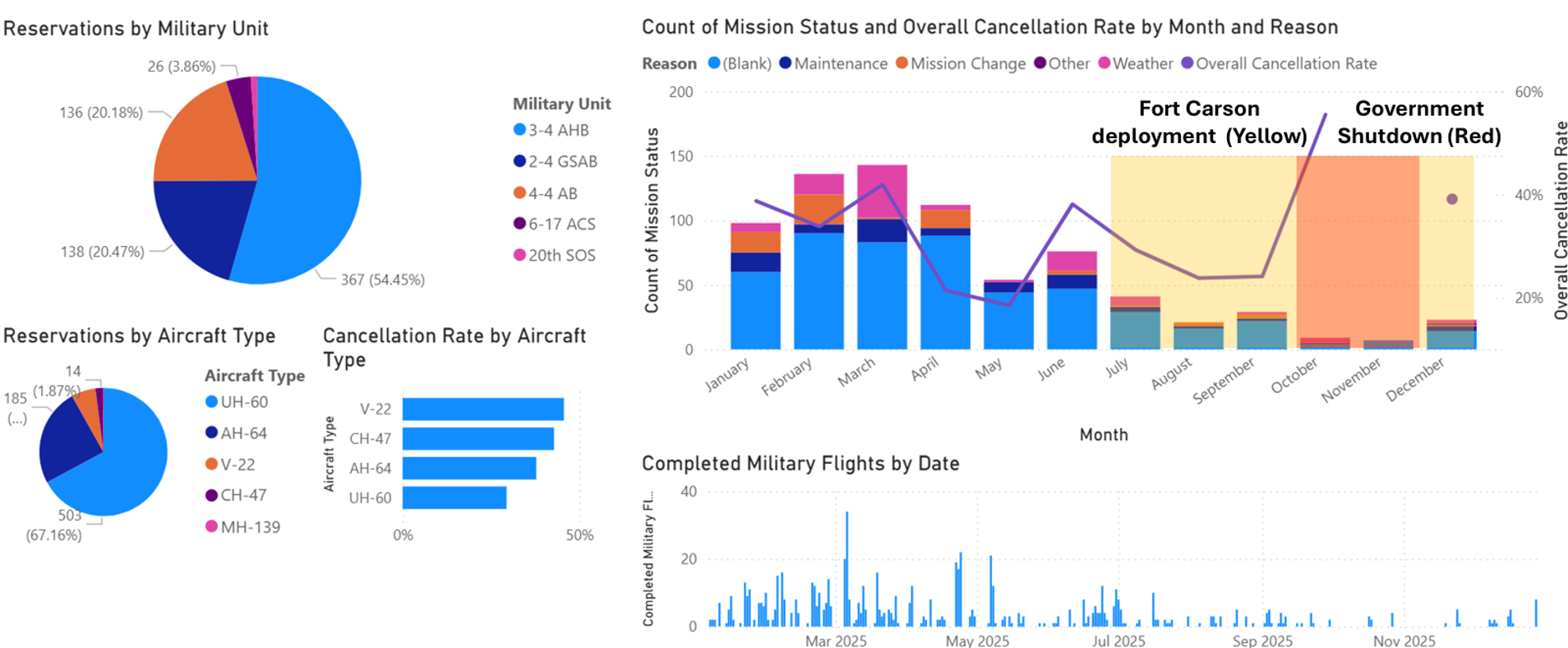

Military Operations

Perry Stokes Airport serves as a key refueling and training location for Army rotary-wing units. The charts below show military reservation and mission data. Note the deployment gap in mid-2025 when the local unit was overseas—operations are expected to resume at full tempo with the 4th Combat Aviation Brigade's return in September 2026.

2024 Military Operations

Click to enlarge

2025 Military Operations

Click to enlarge

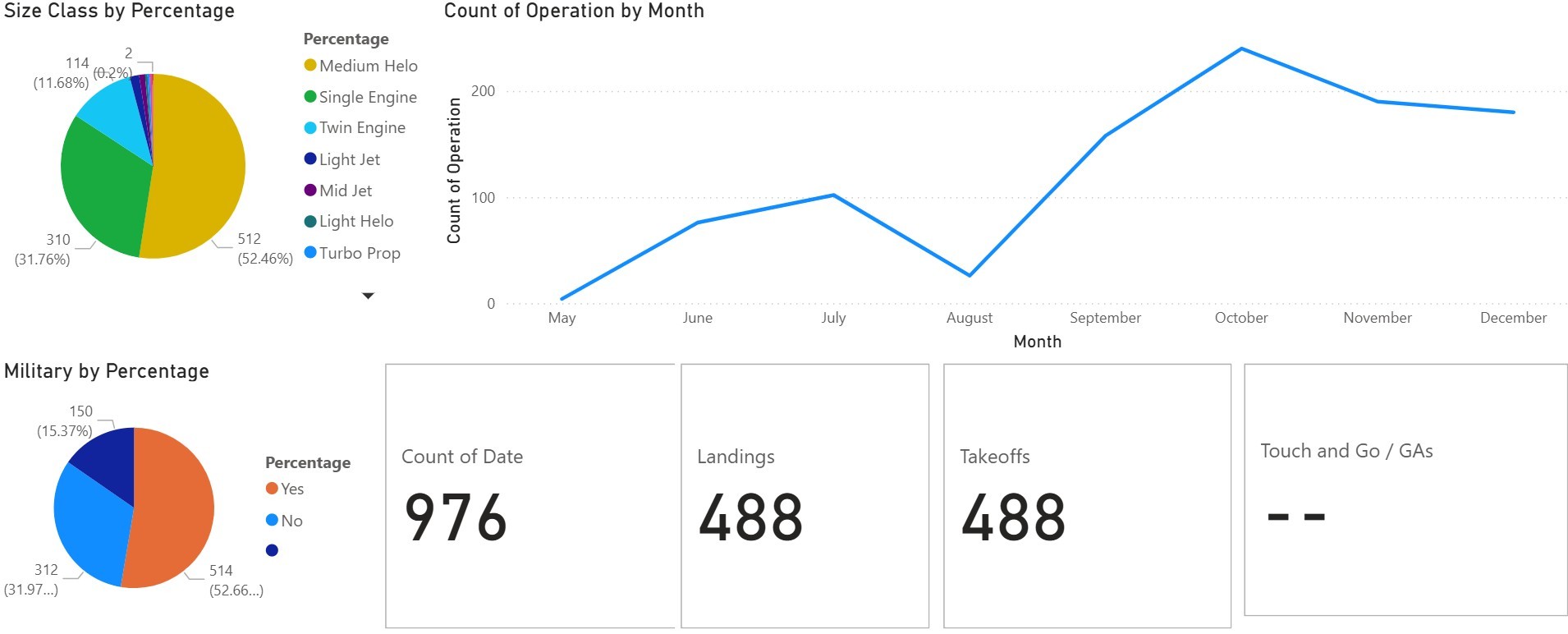

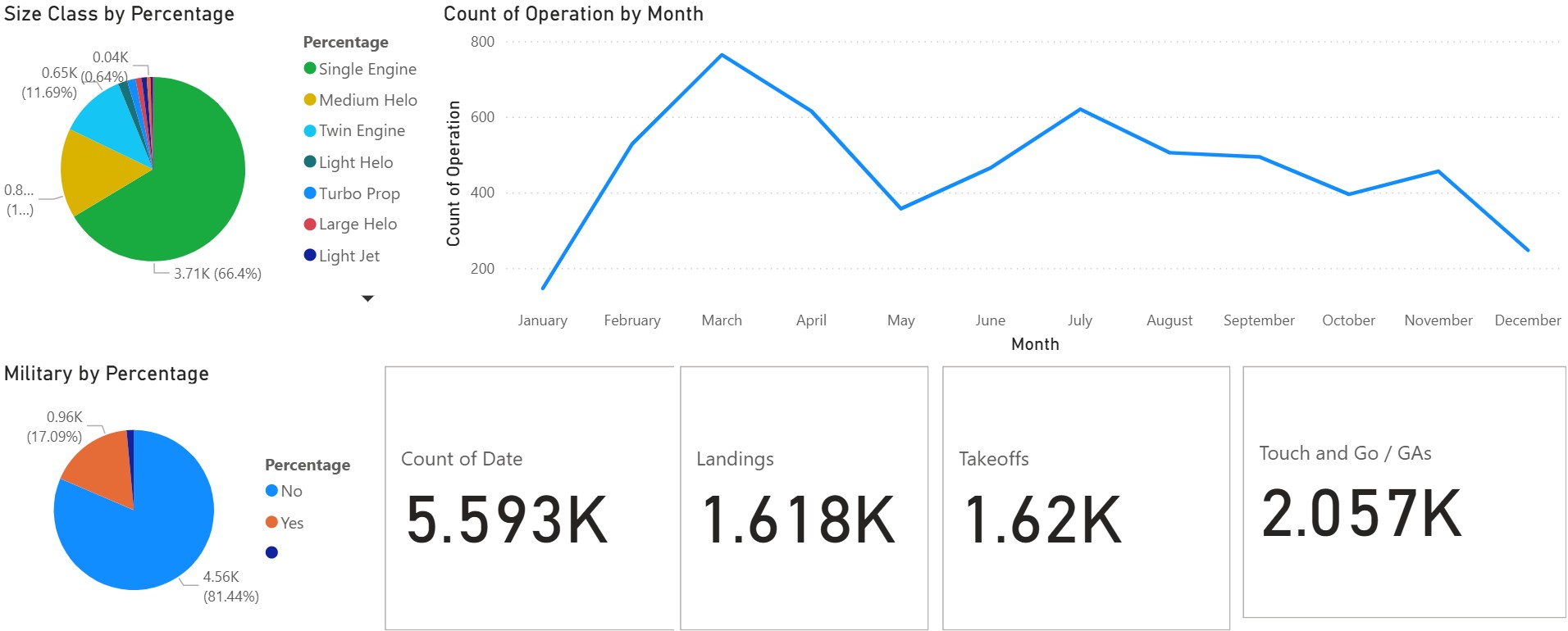

Total Airport Operations

Looking at the 2025 trendline, total operations appear to decline through the year—but this is misleading. The decline is driven almost entirely by reduced CAE flight school traffic (high operation counts but extremely low fuel volumes and minimal local economic impact). This apparent decline completely masks the fact that revenue-producing customers are growing exponentially. The military unit's deployment in July 2025 also contributed to the mid-year dip. Single-engine training operations are expected to decline further in 2026 as CAE reduces class sizes, but the operations that matter—business jets and helicopters—continue their strong upward trajectory.

2024 Total Operations

976 operations (488 landings, 488 takeoffs)

Click to enlarge

2025 Total Operations

5,593 operations (1,618 landings, 1,620 takeoffs, 2,057 touch-and-go)

Click to enlarge

Airport Growth Targets

Hangars and Parking

| Hangars and Parking | 2025 (Actual) | 2030 (Projected) | 2035 (Target) |

|---|---|---|---|

| T-Hangars | 22 | 22 | 22 |

| Privately Owned Hangars | 1 | 4 | 6-12 |

| Overnight Hangar Parking Capacity | 0 | 3 | 3 |

| Jet Parking Spots (Hangar+Outdoor) | 4 | 10 | 10 |

Annual Operations

| Annual Operations | 2025 (Actual) | 2030 (Projected) | 2035 (Target) |

|---|---|---|---|

| Passenger Enplanements | Est 624 | Est 936 | Est 1,344 |

| Business Aviation Operations (Jets+Multi Engine) | 886 (156 jets) | 1,146 (234 jets) | 1,248 (336 jets) |

| Military Aviation Operations (Helicopters) | 668 | 835 | 800 |

| General Aviation Operations (Single Engine) | 7,582 | 9,098 | 12,100 |

Fuel Flowage

| Fuel Flowage | 2025 (Actual) | 2030 (Projected) | 2035 (Target) |

|---|---|---|---|

| Business Aviation Fuel Sales (Jet-A) | 12,376 gal | 24,752 gal | 67,200 gal |

| Military Aviation Fuel Sales (Jet-A) | 155,334 gal | 240,000 gal | 300,000 gal |

| General Aviation Fuel Sales (AVGAS) | 31,364 gal | 37,636 gal | 45,000 gal |

Annual Revenues Generated

| Annual Revenues Generated | 2025 (Actual) | 2030 (Projected) | 2035 (Target) |

|---|---|---|---|

| Flowage Fees paid to LAC | $0 | $15,119 | $20,610 |

| Ground Leases paid to LAC | $1,351 | $6,302 | $11,304 |

| Sales Taxes Paid | $8,848 | $15,718 | $18,136 |

| Fuel Excise Taxes (Fed and State) | $12,378 | $14,480 | $27,994 |

| Payroll Taxes (employee and employer) | $37,796 | $52,914 | $75,592 |

| Total Fed, State, and Local Revenue | $60,373 | $104,533 | $153,636 |

Economic Impacts

| Economic Impacts | 2025 (Actual) | 2030 (Projected) | 2035 (Target) |

|---|---|---|---|

| Direct Employment | 5 | 7 | 10 |

| Indirect Employment (CEIS Airport Study) | Est 35 | Est 49 | Est 70 |

| FBO Local Spend (includes Payroll) | $254,888 | $318,610 | $509,776 |

| Estimated Direct Impact to Tourism (estimated $640 per enplaned passenger) |

Est $399,360 | Est $599,040 | Est $860,160 |

Proposed Airport Fee Schedule

Airport Owned Hangar Monthly Rental

| Airport Owned Hangar Monthly Rental | Current | 2030 | 2035 |

|---|---|---|---|

| T-Hangar | $125/mo | $250/mo | $325/mo |

| End Storage Unit, Medium | $100/mo | $116/mo | $135/mo |

| End Storage Unit, Large | $125/mo | $145/mo | $170/mo |

Ground Lease Rates (On New Leases)

| Ground Lease Rates | Current | 2026 | 2035 |

|---|---|---|---|

| Small Hangar (3,600 sf or below) |

$0.05/sf per year | $100/mo First 5 years, 3% escalation after |

$130/mo First 5 years, 3% escalation after |

| Mid-Sized Hangar (3,601 sf – 10,000 sf) |

$0.05/sf per year | $150/mo First 5 years, 3% escalation after |

$195/mo First 5 years, 3% escalation after |

| Large Hangar (Greater than 10,000 sf) |

$0.05/sf per year | $300/mo First 5 years, 3% escalation after |

$391/mo First 5 years, 3% escalation after |

Fuel Flowage Fees

| Fuel Flowage Fees | 2026 | 2030 | 2035 |

|---|---|---|---|

| Flowage Fees to LAC | $0.05/gallon | $0.05/gallon | $0.05/gallon |

| Flowage Fees to Airport Authority* | N/A | $0.10/gallon | $0.10/gallon |

*PJC proposes establishing the Perry Stokes Airport Authority in 2027. See Perry Stokes Airport Authority project in Part III.

Airport Fee Usage Projections

| Airport Fee Usage | 2025 | 2030 | 2035 |

|---|---|---|---|

| Fees to Las Animas County | $1,351 | $21,421 | $31,904 |

| Fees to Airport Authority | N/A | $113,464 | $134,320 |

| Less Forecasted Airport Management Cost | N/A | ($89,000) | ($109,000) |

| Remaining Funds for Airport Capex | N/A | $24,464/yr | $25,320/yr |

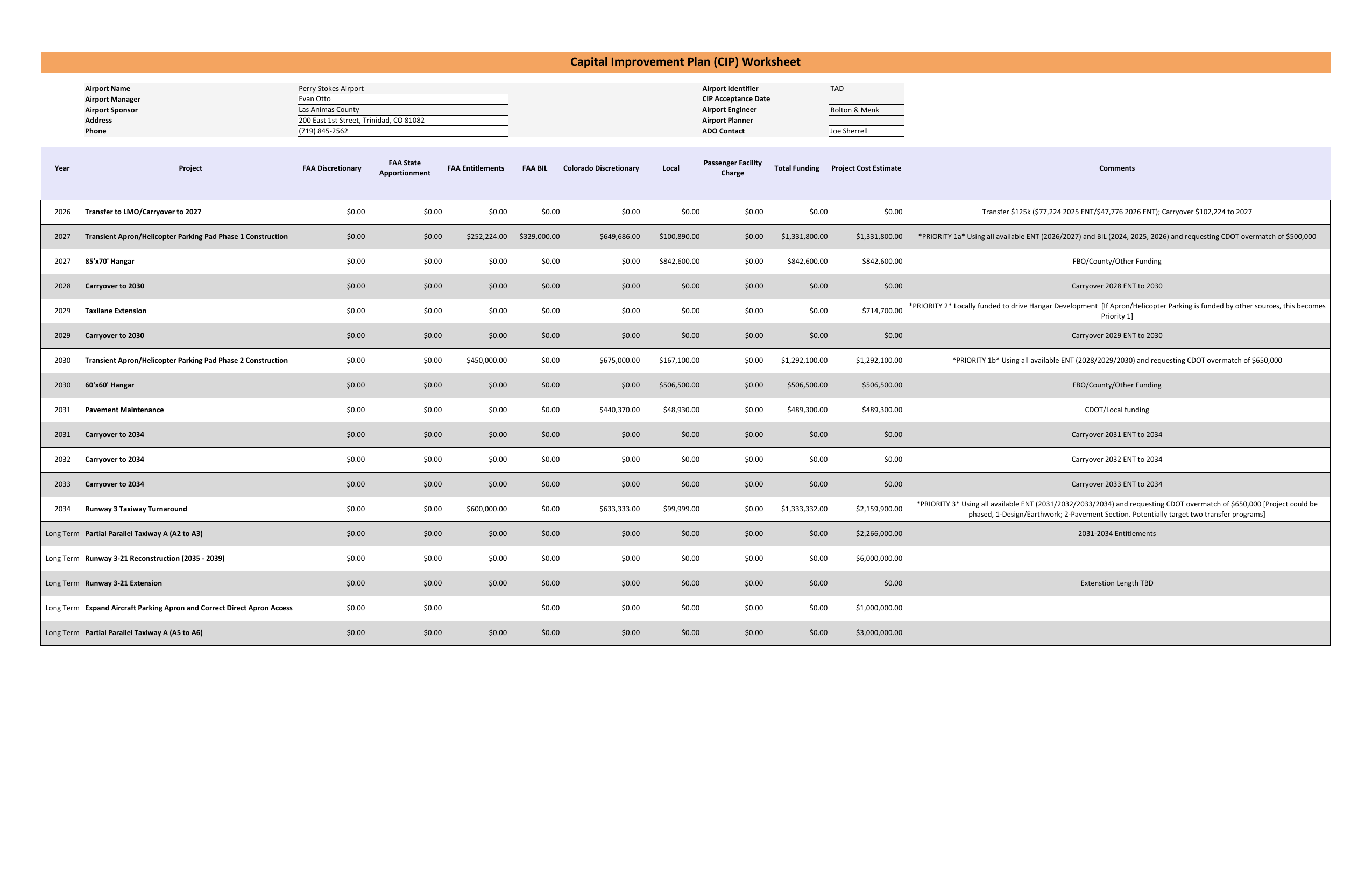

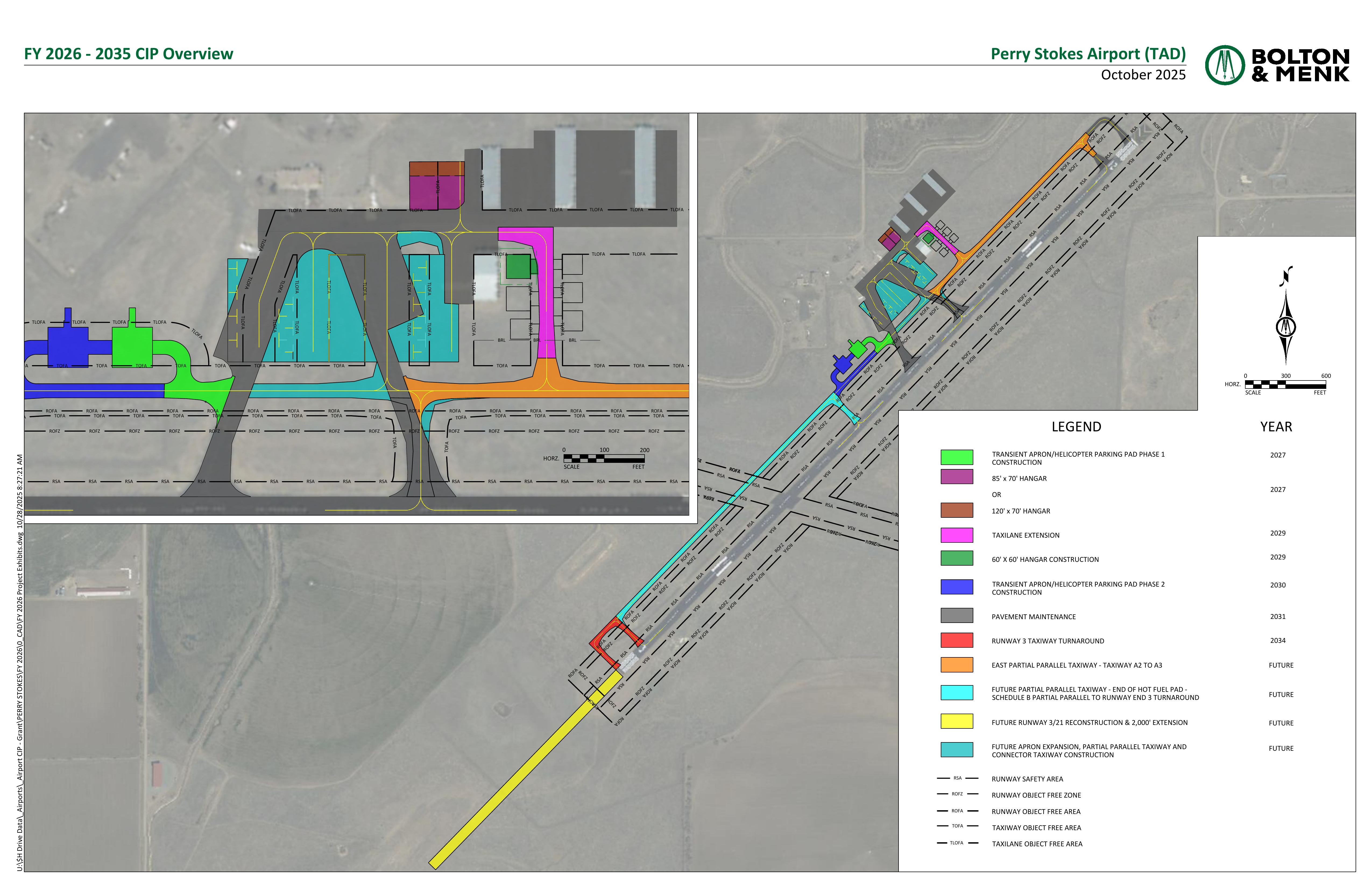

Capital Improvement Plan (CIP) FY 2026-2035

The CIP represents the programmed infrastructure investments for Perry Stokes Airport, coordinated between Las Animas County and the FAA. This 10-year plan identifies funded projects, funding sources, and long-term priorities necessary to support airport growth.

Click image to enlarge

Unmet Funding Requirements

The following projects represent immediate priorities that currently lack secured funding. These investments are critical to supporting airport growth and military readiness.

| Project | Purpose | Estimated Cost | Available Funding & Source | Funding Needed | Status |

|---|---|---|---|---|---|

| Taxilane Extension | Opens 6 new affordable ground lease spots for private hangar construction | TBD | TBD | TBD | Determining Cost Estimates |

| Main Hangar Project (85'x70' or 120'x70') |

Necessary facility upgrade to increase airport utilization from jet traffic | $1,000,000 | $500k, Private Funding – PJC | $500,000 | Seeking Funding |

| Terminal MEP & Windows | Mechanical, electrical, plumbing upgrades and window replacement for historic terminal building | $560,000 | — | $560,000 | Grant Application Submitted |

| Hot Refuel Pads | Hot Refuel area to separate helicopter and plane traffic while increasing overall airport capacity | $2,466,845 | — | $2,466,845 | Grant Application In Progress |

Note: Some projects may qualify for FAA AIP discretionary grants, state aviation grants, or private investment partnerships.

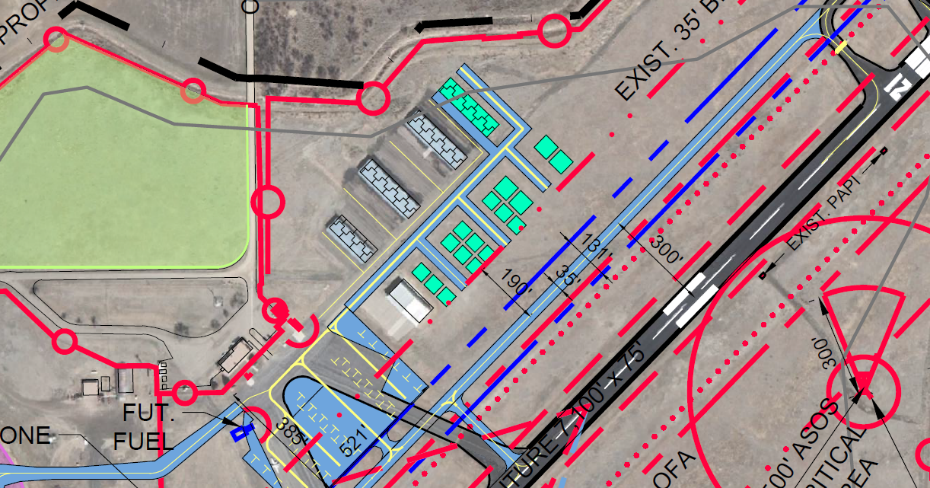

Airport Layout Plan (ALP)

The proposed Airport Layout Plan shows the planned development areas, runway safety zones, and future infrastructure projects. This plan guides all airport development and must be approved by the FAA for any federally-funded improvements.

Click image to enlarge

Key Development Areas Shown:

- 2027: Transient Apron/Helicopter Parking Pad Phase 1, 85'x70' or 120'x70' Hangar

- 2029: Taxilane Extension, 60'x60' Hangar Construction

- 2030: Transient Apron/Helicopter Parking Pad Phase 2

- 2031: Pavement Maintenance

- 2034: Runway 3 Taxiway Turnaround

- Future: Partial Parallel Taxiways, Runway Extension, Apron Expansion

2025 Colorado Aviation Economic Impact Study

The Colorado Department of Transportation (CDOT) Division of Aeronautics conducted the 2025 Colorado Aviation Economic Impact Study to understand how Perry Stokes Airport (TAD) supports economic activity. The study found that TAD generated $2.5 million in total business revenues, supporting 14 jobs and $770,000 in payroll in 2023.

2025 Projects

Bathroom Renovation

2025 • In ProgressStorage Unit Buildout

2025 • In ProgressSeptic System

2025 • Complete2026 Projects

Apron & Teacup Crack Repairs

Spring 2026Airport Seal Coat

Spring 2026Private Hangar Taxilane

2026Rental Car Service

Spring 2026New Radio Frequency (CTAF)

Spring 2026Terminal Renovation

2026-2027If Not Awarded: PJC $48,000

Airport Minimum Standards

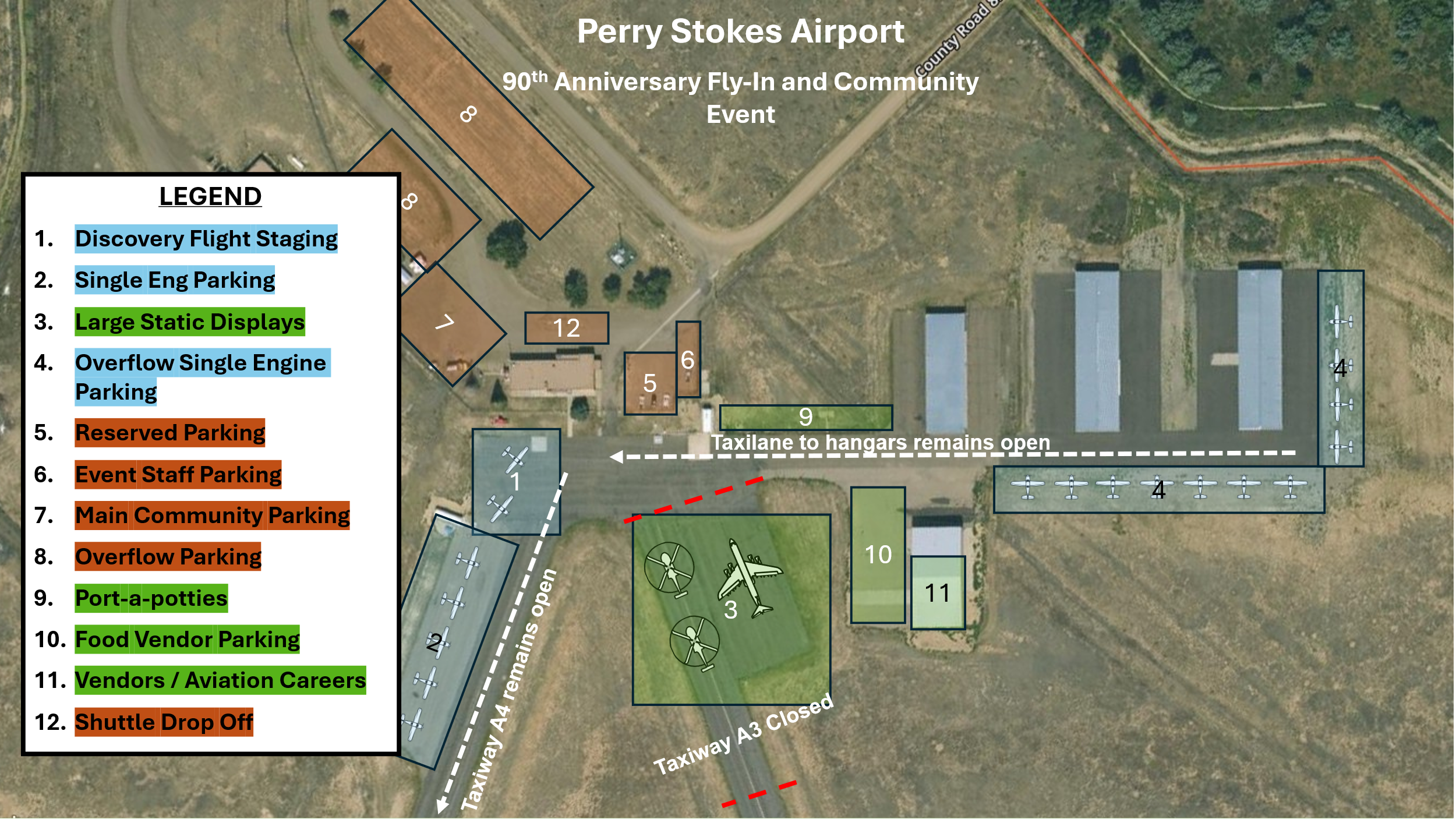

Fall 202690th Anniversary Fly-In & Community Event

August 202690th Anniversary Event Layout

2027 Projects

Establish Perry Stokes Airport Authority

January 2027• Funds 1-2 airport maintenance employees

• Reduces BOCC approval burden for routine decisions, such as renewing leases

• ~$25,000/year retained in Airport Capital Fund

Main Hangar Construction

Summer 2027• Double business aviation fuel sales (12K→24K gal/yr)

• ~100 additional monthly tourist visits by 2030

• Est. $768,000/year local economic impact

Full Service FBO Equipment

Jan-Jul 2027• Lavatory service cart

• Ground Power Units (GPU) with electrical infrastructure

• De-ice cart for winter operations

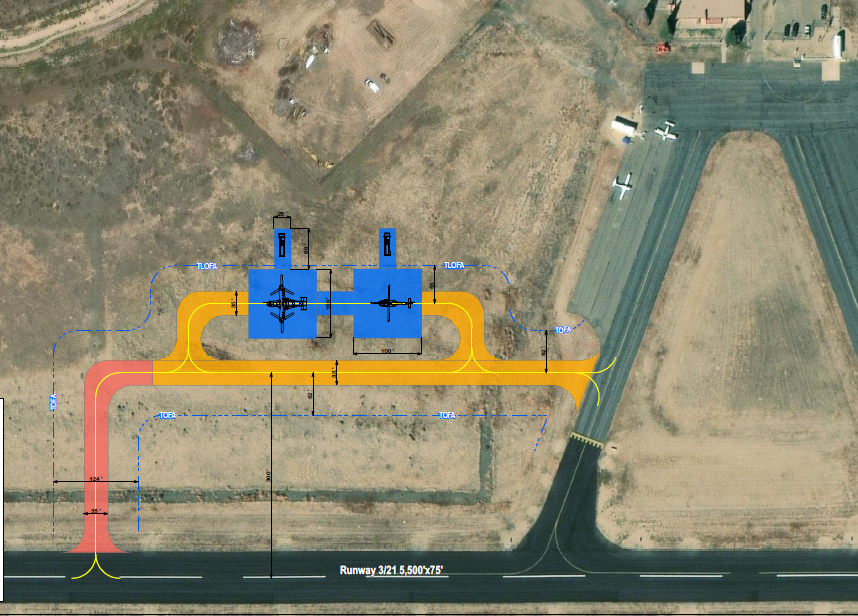

Dedicated Hot Refuel Point Installation

2027-2030Capacity: Double fuel throughput for large helicopter flights (4+ aircraft).

Backup: FAA/CDOT Discretionary Funds

Local Match: Up to 5%

Schedule B (South Pad): 2028-2029

Schedule C (Optional Taxiway): 2029-2030

Hot Refuel Point Design

Blue = Schedule A (North Pad) • Yellow = Schedule B (South Pad + Taxiway) • Red = Schedule C (Optional)

2028-2029 Projects

Private Hangar Development

2028-2029AVGAS Fuel Truck

2028DLA & CAA Fuel Contracts

2028Parking Lot Repairs

2028Airport Layout Plan - Future Hangar Development Areas

Green areas indicate planned private hangar development zones